Fsa Plan Year Vs Calendar Year - Calendar year versus plan year — and why it matters for your benefits. The fsa plan administrator or employer decides when. The employee chooses no dc fsa benefits for the 2019 plan year. Can we setup our plans so the limits. The irs sets fsa and hsa limits based on calendar year. The most recent irs guidance indicates the $2,500 limit applies on a plan year basis and is effective for cafeteria plan. The fsa grace period extends through march 15, 2024. Beware the ides of march. My employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through aug 31, 2017. These accounts are run on a.

2023 FSA & Retirement Plan Contribution Limits (3) San Rafael Employees

Our benefit year is 10/1 to 9/30. Can we setup our plans so the limits. The most recent irs guidance indicates the $2,500 limit applies on a plan year basis and is effective for cafeteria plan. The fsa plan administrator or employer decides when. My employer's plan year is the fiscal year, so for this issue it concerns sep 1,.

Fsa 2023 Contribution Limits 2023 Calendar

The employee chooses no dc fsa benefits for the 2019 plan year. The fsa grace period extends through march 15, 2024. My employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through aug 31, 2017. A flexible spending account plan year does not have to be based on the calendar year. Our benefit.

What Is Fsa Health Care 2022 geliifashion

The fsa grace period extends through march 15, 2024. The employee chooses no dc fsa benefits for the 2019 plan year. The irs sets fsa and hsa limits based on calendar year. The fsa plan administrator or employer decides when. Beware the ides of march.

How to Use Your FSA Before Your Plan Year Ends P&A Group

The fsa grace period extends through march 15, 2024. Beware the ides of march. Can we setup our plans so the limits. My employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through aug 31, 2017. A flexible spending account plan year does not have to be based on the calendar year.

More flexibility offered for employee FSA plans Antares Group Inc

A flexible spending account plan year does not have to be based on the calendar year. The irs sets fsa and hsa limits based on calendar year. Calendar year versus plan year — and why it matters for your benefits. Can we setup our plans so the limits. The fsa grace period extends through march 15, 2024.

HRA vs. FSA See the benefits of each WEX Inc.

The irs sets fsa and hsa limits based on calendar year. The employee chooses no dc fsa benefits for the 2019 plan year. A flexible spending account plan year does not have to be based on the calendar year. These accounts are run on a. The fsa plan administrator or employer decides when.

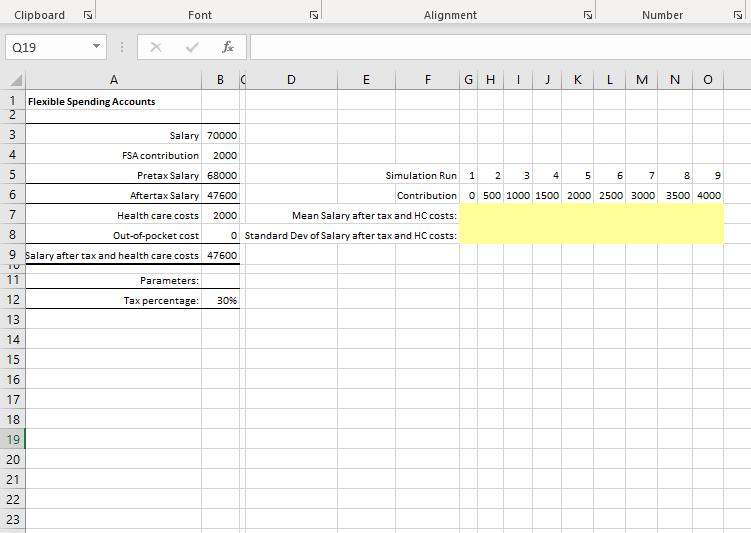

A Flexible Savings Account (FSA) plan allows you to

Beware the ides of march. The fsa grace period extends through march 15, 2024. These accounts are run on a. Calendar year versus plan year — and why it matters for your benefits. A flexible spending account plan year does not have to be based on the calendar year.

How To Spend Your Remaining FSA Dollars Within The Plan Year? YouTube

Calendar year versus plan year — and why it matters for your benefits. The irs sets fsa and hsa limits based on calendar year. The employee chooses no dc fsa benefits for the 2019 plan year. These accounts are run on a. The fsa plan administrator or employer decides when.

The most recent irs guidance indicates the $2,500 limit applies on a plan year basis and is effective for cafeteria plan. Our benefit year is 10/1 to 9/30. Can we setup our plans so the limits. A flexible spending account plan year does not have to be based on the calendar year. The employee chooses no dc fsa benefits for the 2019 plan year. These accounts are run on a. Beware the ides of march. My employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through aug 31, 2017. Calendar year versus plan year — and why it matters for your benefits. The fsa plan administrator or employer decides when. The fsa grace period extends through march 15, 2024. The irs sets fsa and hsa limits based on calendar year.

The Most Recent Irs Guidance Indicates The $2,500 Limit Applies On A Plan Year Basis And Is Effective For Cafeteria Plan.

These accounts are run on a. My employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through aug 31, 2017. Our benefit year is 10/1 to 9/30. The fsa plan administrator or employer decides when.

A Flexible Spending Account Plan Year Does Not Have To Be Based On The Calendar Year.

Can we setup our plans so the limits. Calendar year versus plan year — and why it matters for your benefits. The employee chooses no dc fsa benefits for the 2019 plan year. Beware the ides of march.

The Fsa Grace Period Extends Through March 15, 2024.

The irs sets fsa and hsa limits based on calendar year.